tax avoidance vs tax evasion philippines

There are currently 31 Philippine tax. Delaying or postponing the sale of a.

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

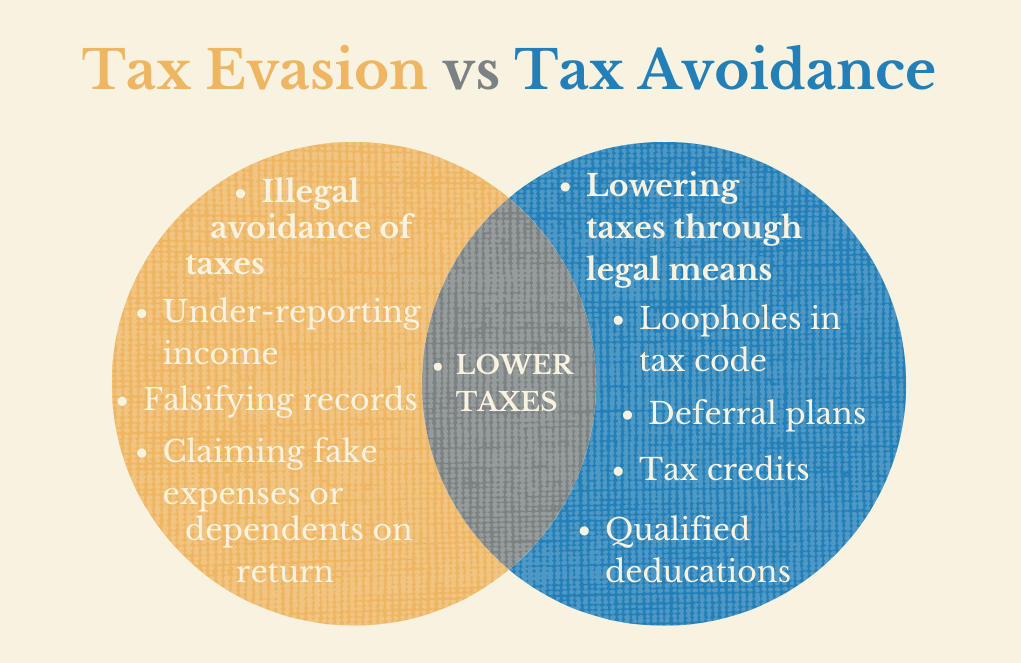

The difference between tax evasion vs tax avoidance is tax evasion is illegal while tax avoidance is unethical.

. Tax avoidance is the use of tax-saving. Tax Avoidance Vs Tax Evasion Philippines. In tax avoidance you structure your affairs.

Some luminaries have 3 categories instead of 2. The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax Evasion vs.

Tax avoidance vs tax evasion 2021-11-18 - MORE TO FOLLOW MTF EUNEY MARIE MATA-PEREZ. Tax evasion occurs when the taxpayer either evades assessment or evades payment. This is entirely different from tax evasion which is.

The biggest difference between the two is that tax avoidance is completely legal. Tax Avoidance Vs Tax Evasion Philippines. Tax Avoidance Vs Tax Evasion Philippines.

Tax avoidance and tax evasion are different methods people use to lower taxes. What is Tax Planning. Moreover tax evaders may face other punishments that include.

This is entirely different from tax evasion which is. Dont know san yung. The Philippines has concluded several tax treaties to avoid double taxation and prevent tax evasion with respect to taxes on income.

Tax July 1 2022 arnold. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. Tax avoidance aka tax minimization is a way taxpayers minimize their taxes through legally permissible means meaning it is not punishable by law.

By Euney Marie Mata-Perez on November 18 2021. To start with tax. Lord Templemans article in a 2001 Law Quarterly Review called Tax.

Important Tax-related Documents You Need to Keep. This penalty can sometimes be up to 75 percent of the taxes owed along with the tax balance itself. Tax Avoidance Vs Tax Evasion Philippines.

In tax avoidance youre making use of your tax benefits to lower taxes for your small business. Tax evasion is the use of illegal means to avoid paying your taxes. Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced.

Tax July 1 2022 arnold. 8 Best Practices for Lowering Your Taxes in the Philippines. So above I started off talking about Tax Evasion vs Tax Avoidance.

The True Cost Of Global Tax Havens Imf F D

Combating International Tax Avoidance Oecd

What Specifically Is Income Tax Evasion And How Is It Punished

Some Of The Ways Multinational Companies Reduce Their Tax Bills Piie

Federal Tax Evasion Why It Matters And Who Does It

Is Democracy Dead The Society Of Honor By Joe America

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

Irs Goes Undercover And The Movement Against Corp Tax Avoidance Htj Tax

Tax Avoidance Is Legal Tax Evasion Is Criminal Wolters Kluwer

Some Of The Best Methods To Prevent Tax Evasion Enterslice

Tax Fraud Vs Tax Evasion Vs Tax Avoidance

Tax Avoidance Vs Tax Evasion What S The Difference Informi

Tax Evasion Penalties Every Taxpayer Must Know

Tax Evasion Vs Tax Avoidance Top 5 Best Differences With Infographics

Tax Morale And International Tax Evasion Sciencedirect

Estimating International Tax Evasion By Individuals

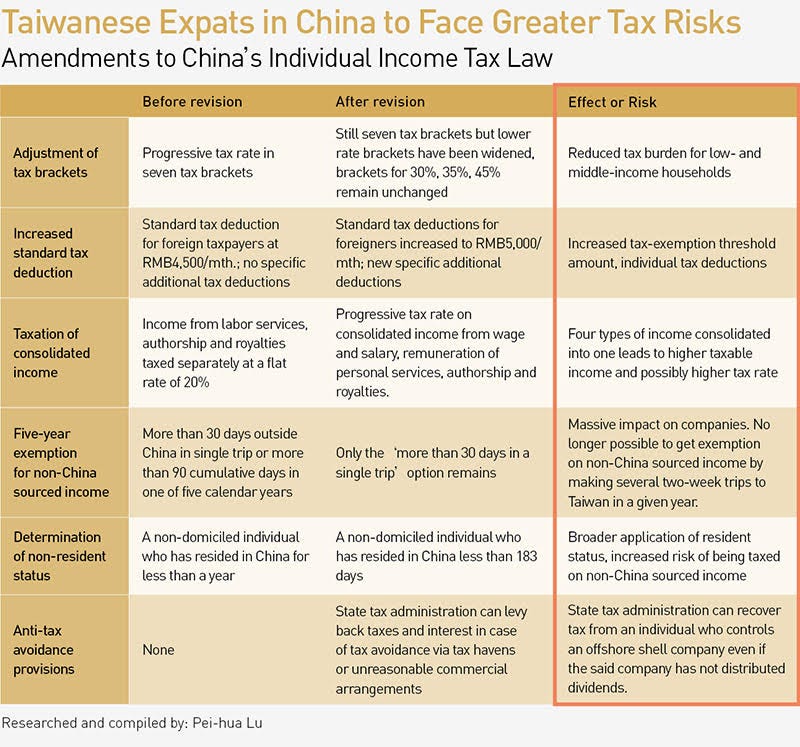

China Cracks Down On Tax Evasion Chasing Every Penny By Commonwealth Magazine Commonwealth X Crossing Medium